roic formula excel: How to calculate ROIC in Excel Easy Excel Tips Excel Tutorial Free Excel Help Easy Excel No 1 Excel tutorial on the internet

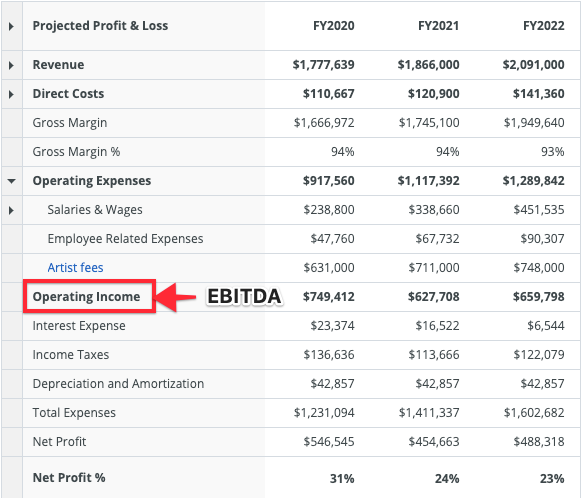

Excess returns may be reinvested, thus securing future growth for the company. An investment whose returns are equal to or less than the cost of capital is a value destroyer. The ROIC calculation begins with operating income, then adds nets other income to get EBIT. Operating lease interest is then added back and income taxes subtracted to get NOPAT.

It is important to look at the ratio from a long term perspective. The internal rate of return is a metric used in capital budgeting to estimate the return of potential investments. For example, suppose you need to calculate an accurate rate of return without any complex Maths. Then, Excel Return on Investment can be beneficial for calculating the benefits you may get as an investor compared to the cost spent on investment. Once the entire forecast has been filled, we can calculate the ROIC in each period by dividing NOPAT by the average between the current and prior period invested capital balance.

There are also adjustments that should be made to prevent uncharacteristic results of ROIC. For example, Earnings from continuing operations may be used while estimating EBIT by removing earnings from discontinued operations and other income. Also while calculating Invested Capital one should add any current portion of short term and long term debt and also remove net assets of discontinued operations. Debt And Equity RatioThe debt to equity ratio is a representation of the company’s capital structure that determines the proportion of external liabilities to the shareholders’ equity. It helps the investors determine the organization’s leverage position and risk level. ROCE calculator is a ready-to-use excel template to calculate ROCE for any company and compare ROCE for 5 years for investing purpose.

Invested Capital

Yarilet Perez is an experienced mulhttps://1investing.in/dia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

If the ROIC of a company lies over 2%, the company creates value for its shareholders. On the other hand, companies with less than 2% of ROIC are called value destroyers. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. You can more accurately compare two companies with differing amounts of debt and disparate asset bases by using NOPAT instead of net income. The recovery percentages are assumed to be 100% in Year 1, followed by an annual increase of 50% each year until Year 5, the end of the holding period.

Excel Calculating Investment Return

Earnings before any interest expense on debt can be determined by analyzing the company’s income statement. This element of the equation is also called net operating profit after tax . Corporate finance data is broken down into profitability and return measures, financial leverage measures, and dividend policy measures. In valuation, he focuses on risk parameters, risk premiums for equity and debt, cash flow, and growth rates. A company can evaluate its growth by looking at its return on invested capital ratio. Any firm earning excess returns on investments totaling more than the cost of acquiring the capital is a value creator and, therefore, usually trades at a premium.

- He publishes datasets every year in January, and the data is grouped into 94 industry groupings.

- A higher MOIC ratio implies a more profitable investment, whereas a lower MOIC indicates the investment is less profitable.

- MOIC stands for “multiple on invested capital” and measures investment returns by comparing the value of an investment on the exit date to the initial investment amount.

- Net Working Capital → The dollar amount of net assets that a business needs to continue operating day-to-day.

Where C2 represents the type of item on the statement and D2 represents the amount. Details In this lesson you can learn how to calculate ROIC in Excel.

It is one of the limitations of the traditional ROI formula, but we can overcome this by using the annualized ROI formula. Similarly, we will calculate the sold value by multiplying no. of shares by the selling price per share. As I’m conversant with this example company, hence I’ve considered a smaller correction factor. For less known companies, I prefer a correction factor of 20% or higher. There are mainly two main parts of the intrinsic value formula. Thefirst partdeals with the future EPS, and thesecond partdeals with the future PE ratio.

Capital Gain

MOIC → The ratio between an investment’s ending value to the initial investment size. Annual Percentage Rate is the interest charged for borrowing that represents the actual yearly cost of the loan expressed as a percentage. Here, for the 3rd row of our data, C3/A3, and apply to all the cells of the data.

Invested by the firm and, after that, understand its related future prospects. In the below-given table is the data of Triumph Solutions for calculation of ROIC. In the below-given template is the data of Company ABC for the ROIC calculation. At the end of 2017, they made a Net profit of $575,000 and paid $100,000 as dividends to stockholders. It nullifies the impact of leverage when ROE doesn’t portray the actual profitability.

What’s a good return on invested capital (ROIC) value?

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral roic formula excel. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

By calculating your total return in Excel, you’re looking at a percentage gain or loss just like your capital gain formula. But the key difference between total return and capital gain is that your total return formula looks at the original value versus your current value. Return on investment is a key business performance metric that companies and individuals use to calculate how efficient or profitable their investment is. It can also be used to compare different types of investments to figure out your net profit for each investment option.

If not, then the firm can make the necessary adjustments. In contrast, an investment’s IRR can vary substantially under different exit date assumptions, as longer holding periods tend to cause returns to decline . The sensitivity of the IRR to the exit date is one drawback to the metric, which reflects again the importance of using more than one metric to understand the full picture. Like ROE % and ROA %, ROIC % is calculated with only 12 months of data. Fluctuations in the company’s earnings or business cycles can affect the ratio drastically.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Economic Value Added (EVA) Definition: Pros and Cons, With Formula – Investopedia

Economic Value Added (EVA) Definition: Pros and Cons, With Formula.

Posted: Sun, 26 Mar 2017 00:33:00 GMT [source]

The formula for calculating the return on invested capital consists of dividing the net operating profit after tax by the amount of invested capital. ROIC stands for Return on Invested Capital and is a profitability or performance ratio that aims to measure the percentage return that a company earns on invested capital. The ratio shows how efficiently a company is using the investors’ funds to generate income. Benchmarking companies use the ROIC ratio to compute the value of other companies. Return on Invested Capital can be used as a proxy for the growth of the company. ROIC is generally compared to Weighted Average Cost of Capital for the company.

It should be compared to a company’s cost of capital to determine whether the company is creating value. Hence, analyzing the structure of its components would give a much better understanding to investors and analysts. A higher debt component may also mean that the company is using up its debt to generate returns – it may require to repay a higher component of returns to its loans. The “Return” that the company has generated from all the capital it has used up during the period.

Since the WACC is the average after-tax cost of a firm’s capital, it can be compared to ROIC. If the ROIC is greater than the WACC, then the financial manager knows that they are creating value in the business. If it is less, they are diminishing value with their investment choices and should adjust their parameters. The first is the use of operating income or EBIT rather than net income in the numerator. The second is the tax adjustment to this operating income or EBIT, computed as a hypothetical tax based on an effective or marginal tax rate. The third is the use of book values for invested capital, rather than market values.

Our sabbatical calculator will help you plan your leave from work in a way that ensures you don’t run out of money. If you are looking for other investment options, we recommend checking our systematic investment plan calculator. There are two components that make up the equation used to calculate a business’s ROIC. The completed returns schedule from our hypothetical LBO scenario is as follows. Using the example from the earlier section, the MOIC is 4.0x irrespective of the actual holding period.

Aswath Damodaran is a lecturer at the New York University Stern School of Business, teaching corporate finance, valuation, and investment philosophies. Damodaran has written on the subjects of equity risk premiums, cash flows, and other valuation-related topics. Our templates are supported by our all-in-one platform to automate calculations for you and even. Combine all of your financials into one flexible dashboard. This empowers you with a real-time view of key ROI metrics like net income, capital gains, total returns, and annual returns. The ROIC formula is net operating profit after tax divided by invested capital.

Then, net income and equity value forecasts are derived and returns are compared over the long term by the company. The sensitivity of returns to the core assumptions is also provided. Another valuable metric with which ROIC can be compared is the firm’s weighted average cost of capital .

Let’s say they have no debts, and the capital from equity equals $121.5k. Let’s build the return on capital employed calculator in Excel. The process of calculating the internal rate of return in Excel involves using the “XIRR” function, wherein the first array is a row of dates and the second array is the “Cash Inflows / , net” . The multiple on invested capital is the ratio between two components, which determines the gross return. The multiple on invested capital essentially represents the returns earned per dollar of initial investment contributed. Excel Corp provides financial and transaction processing services to small and medium-sized businesses throughout the United States.

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/zh-TC/register-person?ref=W0BCQMF1